You’ve likely heard about credit scores before (thanks to all those commercials with terrible jingles), but what do you actually know about them?

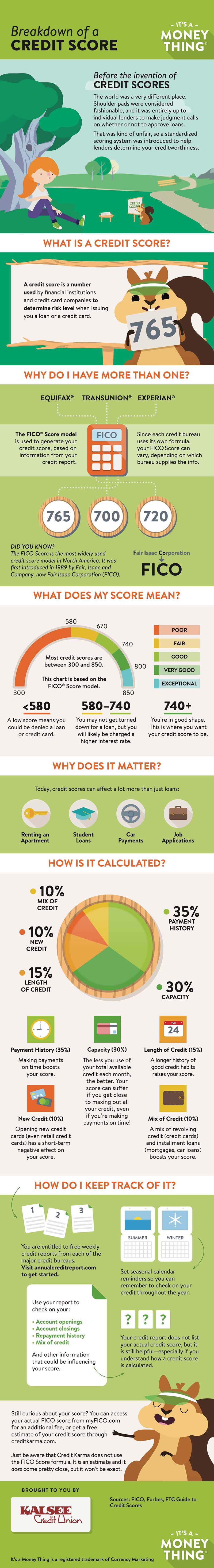

A credit score is a number (usually between 300 and 850) that represents your creditworthiness.

It’s a standardized measurement that financial institutions and credit card companies use to determine risk level when considering issuing you a loan or a credit card. Basically, it provides a snapshot of how likely you are to repay your debts on time. Widespread use of credit scores has made credit more widely available and less expensive for many consumers.

The credit scoring system that we’re familiar with today has been around since the 1980s. Before then, there was no standardized way to measure creditworthiness, so it was up to individual lenders to make judgment calls on whether or not to loan money to someone. The old system was time-consuming, inconsistent and quite biased, so a credit scoring system was introduced.

The FICO® Score is the best known and most widely used credit score model in North America. It was first introduced in 1989 by FICO, then called Fair, Isaac and Company. The FICO Score model is used by the vast majority of banks and credit grantors, and is based on consumer credit files from the three national credit bureaus: Experian, Equifax and TransUnion. Because a consumer’s credit file may contain different information at each of the bureaus, FICO scores can vary, depending on which bureau provides the information to FICO to generate the score.

When credit scores were first introduced, they were used primarily for loaning money. Today, credit scores have much more pull, and that’s why it’s important to understand how they’re calculated. Your monthly car payments, your ability to snag that sweet apartment and even the hiring manager’s decision on that new job you applied for can all be influenced by your credit score.

A very good (740-800) or exceptional (800+) credit score means you’re in good shape.

Taking the time to familiarize yourself with how credit scores are calculated is the first step in getting a strong score.

Each credit bureau uses a slightly different calculation, but the basic breakdown goes like this:

- 35% is based on payment history. Making payments on time boosts your score.

- 30% is based on capacity. This is one of the areas where the less you use of your total available credit, the better. If you get close to maxing out all your credit cards or lines of credit, it tanks your score, even if you’re making your payments on time.

- 15% is based on length of credit. Good credit habits over a long period of time raise your score.

- 10% is based on new credit. Opening new credit cards (this includes retail credit cards) has a short-term negative effect on your score, so don’t open a whole bunch at once!

- 10% is based on mix of credit. Having a combination of different types of credit (like revolving credit and installment loans) boosts this part of your score. Credit cards are considered revolving credit, and things like car loans and mortgages are installment loans.

Curious about your credit report?

More to Explore

How Do I...

Click to locate a fee-free ATM near you. Did you know you can use credit union CO-OP network ATMs and fee free?