Beware of Fast Cash

Like local car dealerships and personal injury law firms, short-term and payday lenders tend to have the most annoying commercials on TV. They’re often tacky and annoying, and tend to air during daytime talk shows or very late at night. Their promises of “fast cash!”, “guaranteed approval!” and no “credit check required!” are enough to make you change the channel—and yet, if you ever find yourself in a situation where you need to get your hands on some extra money fast, those commercials might start making sense to you. If your car breaks down or you are short for this month’s rent payment and you have no emergency funds set aside, going to a payday lender or a pawnbroker may seem like your only options. However, the loans that they offer can be outrageously expensive and targeted at people who are clearly in a tight spot to begin with, which makes those businesses prime examples of predatory lending.

Before jumping at that fast-cash offer, take a moment to educate yourself about predatory lending. Then breathe, understand that you have alternatives, and make an action plan.

What is Predatory Lending?

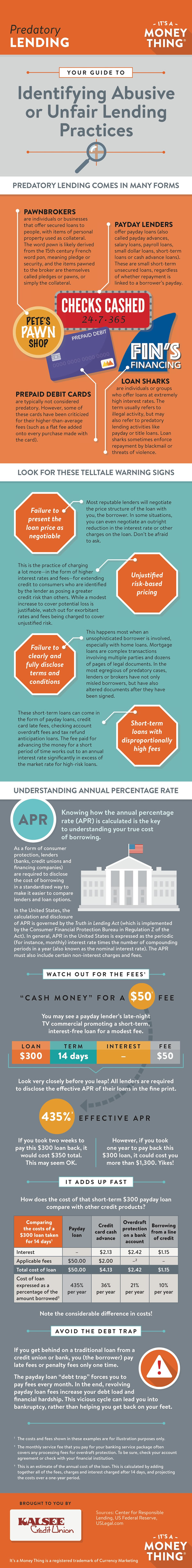

According to Debt.org, predatory lending is any lending practice that imposes unfair or abusive loan terms on a borrower. It is also any practice that convinces a borrower to accept unfair terms through deceptive, coercive, exploitative or unscrupulous actions for a loan that a borrower doesn’t need, doesn’t want or can’t afford. By definition, predatory lending benefits the lender, and ignores or hinders the borrower’s ability to repay the debt. These lending tactics often try to take advantage of a borrower’s lack of understanding about loans, terms or finances.

Predatory lenders typically target minorities, the poor, the elderly and the less educated. They also prey on people who need immediate cash for emergencies such as paying medical bills, covering a home repair or making a car payment. These lenders also target borrowers with credit problems or people who have recently lost their jobs. While the practices of predatory lenders may not always be illegal, they can leave victims with ruined credit, burdened with unmanageable debt, or homeless.

Predatory lenders go by a number of names.

Pawnbrokers are individuals or businesses that offer secured loans to people, with items of personal property used as collateral. The word pawn is likely derived from the 15th century French word pan, meaning pledge or security, and the items pawned to the broker are themselves called pledges or pawns, or simply the collateral.

Payday lenders offer payday loans (also called payday advances, salary loans, payroll loans, small dollar loans, short-term loans or cash advance loans). These are small short-term unsecured loans, regardless of whether repayment is linked to a borrower’s payday.

Prepaid debit cards are typically not considered predatory; however, some of these cards have been criticized for their higher-than-average fees (such as a flat fee added onto every purchase made with the card).

Loan sharks are individuals or groups who offer loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending activities like payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence.

Predatory lending can also take the form of car loans, sub-prime loans, home equity loans, tax refund anticipation loans or any type of consumer debt. Common predatory lending practices include a failure to disclose information, disclosing false information, risk-based pricing, and inflated charges and fees. These practices, either individually or when combined, create a cycle of debt that causes severe financial hardship for families and individuals.

You have alternatives.

If you are facing debt problems, you may feel that these types of lenders are your only option. Not true—you have a number of alternatives to taking out a high-cost loan:

Payment plan with creditors — The best alternative to payday loans is to deal directly with your debt. Working out an extended payment plan with your creditors may allow you to pay off your unpaid bills over a longer period of time.

Advance from your employer — Your employer may be able to grant you a paycheck advance in an emergency situation. Because this is a true advance and not a loan, there will be no interest.

Credit union loan — Credit unions typically offer affordable small short-term loans to members. Unlike payday loans, these loans give you a real chance to repay with longer payback periods, lower interest rates, and installment payments.

Consumer credit counseling — There are numerous consumer credit counseling agencies throughout the United States that can help you work out a debt repayment plan with creditors and develop a budget. These services are available at little or no cost. Kalsee offers Aspire Financial Counseling. Or, the National Foundation for Credit Counseling (nfcc.org) is a nonprofit organization that can help you find a reputable certified consumer credit counselor in your area.

Emergency Assistance Programs — Many community organizations and faith-based groups provide emergency assistance, either directly or through social services programs for weather-related emergencies.

Cash advance on your credit card — Credit card cash advances, which are usually offered at an annual percentage rate (APR) of 30% or less, are much cheaper than getting a payday loan. Some credit card companies specialize in consumers with financial problems or poor credit histories. You should shop around, and don’t assume that you do not qualify for a credit card. Kalsee offers credit card cash advances at the same great, low rate as purchases, with no cash advance fee.

Ultimately, you should know that you are in control, even if you find yourself in financial difficulties. There are plenty of alternatives to avoid high-cost borrowing from predatory lenders. Take time to explore your options.

More to Explore

How Do I...

Activate My Card or Change My PIN?

Call 866-985-2273 from the phone associated with your account to activate your card or to change or set your card PIN.

Change My Address?

Login to your account online, call 269-382-7800, or visit any branch with a valid ID and correct address.

Find a Branch and ATM?

Click to view our locations and hours.

Click to locate a fee-free ATM near you. Did you know you can use credit union CO-OP network ATMs and fee free?

Click to locate a fee-free ATM near you. Did you know you can use credit union CO-OP network ATMs and fee free?

Apply for a Loan or Pre-Approval?