Kalsee Credit Union

You Matter To Us

We're here to help, always.

You can count on Kalsee for spectacular rates.

Whether you're buying your dream car, renovating your forever home, or building savings for what matters most, our rates are designed to help you do more with your money. At Kalsee, it's not just about numbers — it's about empowering your goals, your peace of mind, and your future.

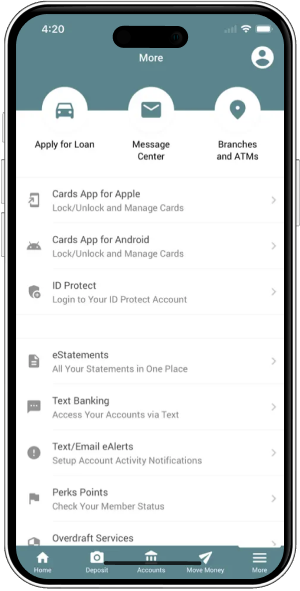

Scan with your phone camera to download

Download our mobile banking app today.

With our mobile app, your credit union is always open. Access your accounts, make transactions, and more, all day, every day.

We’re just around the corner.

We believe in...

Building relations and cultivating financial wellness, empowering people to focus on what matters.

We're proud of what we've created. We want you to be a part of it, too.

“Kalsee is like family, really. They bent over backwards for us on numerous occasions when other banks treated us like a number. Kalsee went to bat for us when nobody else would. We switched over everything. I like the small town feel of a credit union, you get more of a personal touch. We couldn’t be happier with Kalsee.”

Up Next