Limited time!

4.99% APR1 thru 2026 on balance transfers!

Ends 2/28, so don’t delay!

Life’s complicated. Your cash back doesn’t have to be. No categories to keep track of, no minimums or maximums.

- 1.5% cash back on all purchases in a monthly statement credit or deposit to checking or savings, with no limit

- Credit limits from $5,000 to $30,000

- Cash Back Visa Signature® Business also available

- Visa Signature benefits3, like Roadside Dispatch, Travel Emergency Assistance Services, Identity Theft Protection, Visa Concierge, Visa Luxury Hotel Collection, and other discounts

Every dollar counts. Save with our lowest rate. A simple card with the best value for your balance.

-

Low variable rate

-

Credit limits from $300 to $30,000

-

Secured option for building or repairing credit

-

Visa Traditional benefits3, like Roadside Dispatch, Identity Theft Protection, and other discounts

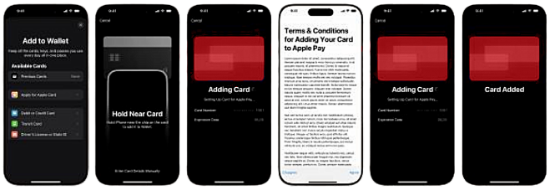

Mobile Payments

Now available: Tap to add your cards to your mobile wallet!

How it works:

No additional action required.

Cards App

Protect your cards from fraud attempts. Lock/unlock your cards in real time, report cards lost or stolen, set limits on the amounts or types of transactions allowed on your card, notify us when you plan to travel, and receive card activity notifications.

Security Features

You can shop with confidence online and anywhere else when you use your Kalsee Visa credit card. Plus, your card is safer than carrying cash. That’s because Kalsee and Visa work 24/7 to prevent, detect, and resolve fraud.

- EMV chip technology

- Proactive, real-time fraud monitoring

- Identity theft assistance

- Our Zero Liability4 policy means you don’t pay for unauthorized use of your credit card

- With Verified by Visa, your identity is confirmed through a personal password while shopping at participating online merchants

Easy Payment Options

Make payments from your Kalsee account instantly or from your other financial institution via ACH transfer. Or simply transfer funds for a cash advance.

FAQs:

When used carefully, a credit card is a great tool for building credit. Your credit score takes into account a number of factors, such as types of credit (installment vs. revolving), length of credit history (the longer you've had the account/loan, the better), and of course how well you make your payments. Opening a credit card account as early as possible can help you establish longer credit history. And responsibly maintaining your credit card helps prove to future lenders that you're a safe borrower. A secured credit card (secured by funds held in a savings account) is a great option for getting started.

Just be careful not to build up a balance that you can't easily repay. Suggestion: Designate your credit card for certain types of purchases only (gas is a great option due to the large holds gas stations place on pre-authorized pump purchases—it's a good idea not to tie up your debit card/checking funds with that hold).